The big shot asset managers like BlackRock, VanEck, Grayscale Investments, Hashdex, Valkyrie, etc have all been on a mission to launch a Bitcoin ETF for what feels like forever. However, the wait almost seems over.

Word on the crypto streets is that asset managers could get the golden ticket of approval today or tomorrow. But, wait for it – other rumors spilling the beans are saying that the SEC is drowning in paperwork, so we typically won't expect managers to hear back until the decision deadline on Jan. 10.

Just a few days more to wait!

You are probably wondering: why is the Bitcoin ETF the next big thing after slice bread? Well, in short, Bitcoin and Ethereum ETFs mean only one thing: Institutional money.

For most of bitcoin's history (and indeed all of cryptos'), only individuals, traders and companies with high risk portofolios hold bitcoin. This means long standing conservating investment powerhouses are usually shy of investing a lot of money into crypto. The ETFs are expected to change that and bring a lot of "old money" into Bitcoin and crypto.

Folks are literally daydreaming about trillions of institutional dollars flooding into Bitcoin from the companies filing these ETFs, making its price fly to the moon.

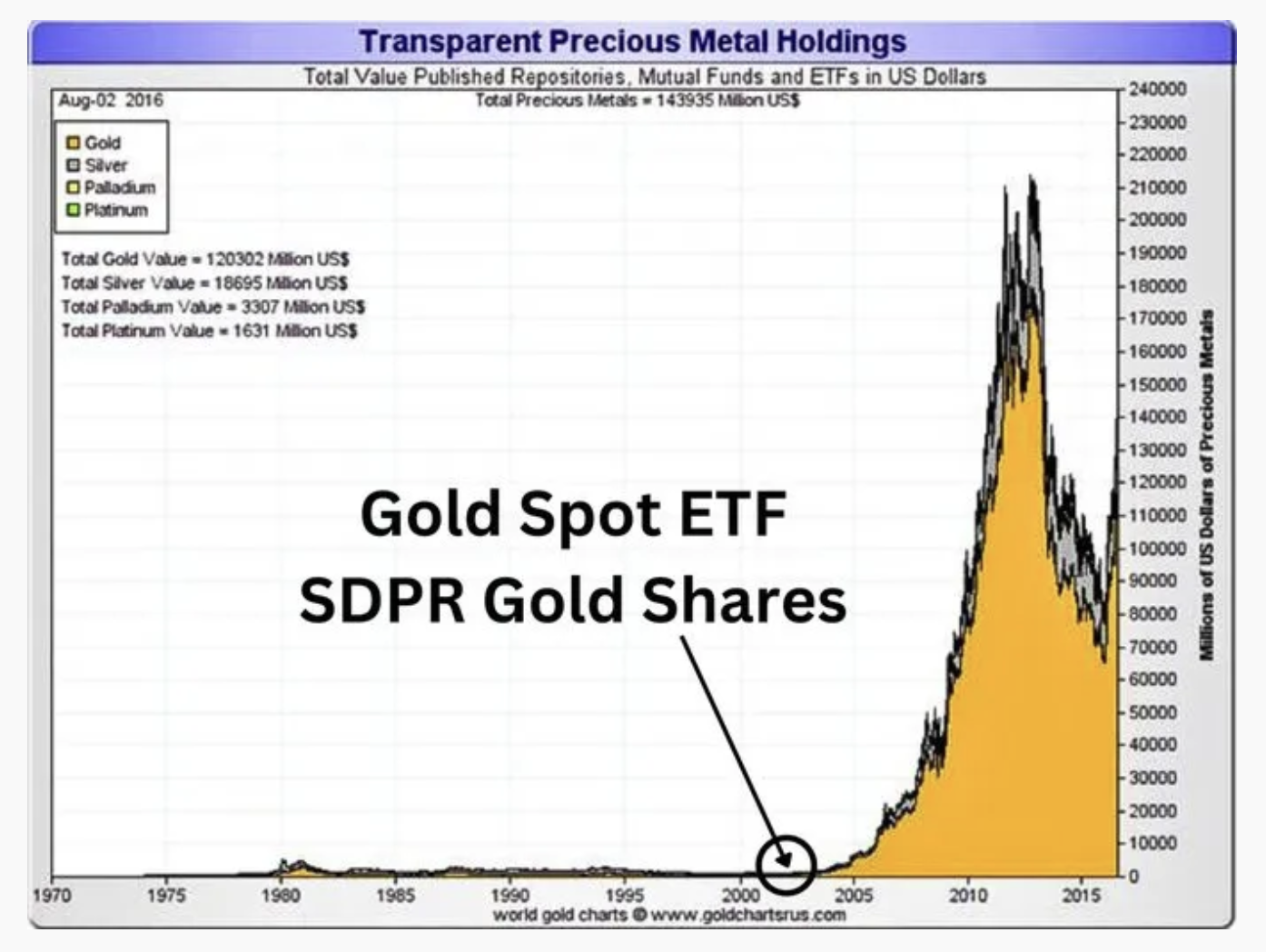

Another Long term effect of this ETF is that there is a chance it becomes Gold ETF 2.0.

Gold went on an 8-year bull run when its Spot ETF was approved, setting a new all-time high, and briefly wore the crown as the world's biggest ETF. ETFs are no joke and that is precisely why so many fingers are crossed to see them finally launch!